Griping about property taxes has become more of a Garden State cliché than anything reality television could ever dream up, but recently released numbers examining the issue show that the complaining is probably a bit warranted.

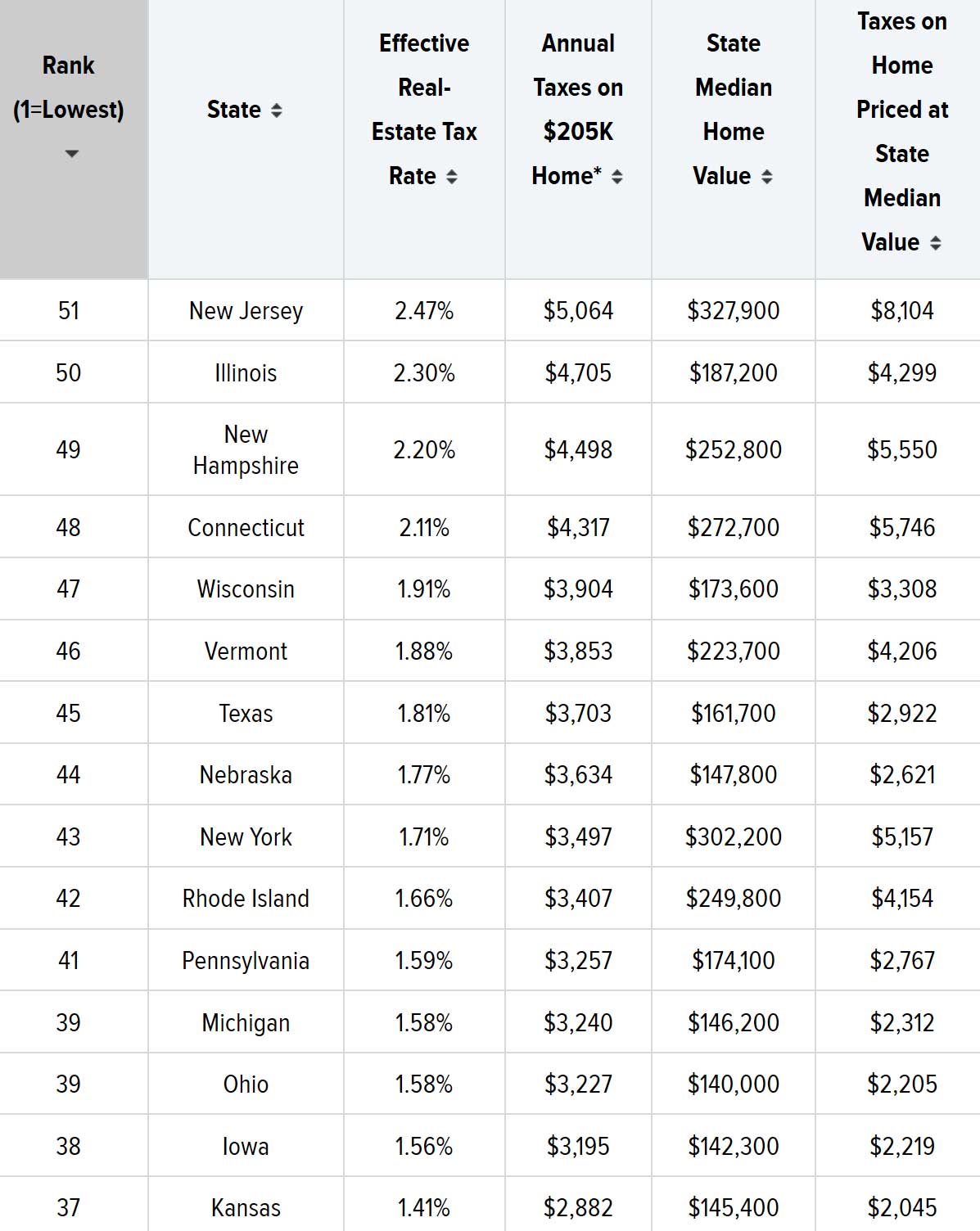

WalletHub, a Washington D.C.-based finance website, recently released a study detailing the states with the highest and lowest property taxes. The company’s methodology divided the median real estate tax payment by the median home price for every state plus the District of Columbia and then used the rates to obtain the property taxes that would be paid on a house worth $204,900, which is the median 2018 value for a home in the U.S. according to the Census Bureau.

In a surprise to few, New Jersey ranked 51st for property taxes and had an effective real estate tax rate of 2.47%. The Garden State had the 5th highest state median home value at $327,900 and on average, a taxpayer owning a house at that number would shell out $8,104/year in property taxes.

If there’s any consolation in the numbers for New Jersey’s residents, it’s that their neighbors in nearby states feel their pain. The Northeast as a region fared very poorly in terms of annual taxes assessed on a home priced at the state median value; the bottom five consisted of New Jersey, Connecticut, New Hampshire, New York, and Massachusetts.

The lowest effective property tax rate in the country was on homes in Hawaii, which are taxed at just 0.27%. Alabama, thanks in part to an average home price of just $137,200, had the lowest average annual taxes on a home priced at the state median at only $572/year.

The study also looked at vehicle property taxes, which apply in 27 states but not in New Jersey. The two highest rates for that tax, which taxes the assessed value of cars residents own, were Virginia’s 4.05% and Mississippi’s 3.50%.

The WalletHub study concluded that the average American household spends $2,375 on real estate property taxes plus another $441 for residents of the 27 states with vehicle property taxes.

Related:

- Study Claims New Jersey Has the Most Outbound Moves in America

- These Are The Most Expensive, Cheapest Places to Rent in NJ

- Two N.J. Zip Codes Rank Among the Country’s Top 125 Most Expensive