In what shaped up to be a banner year, Jersey City closed 2016 out strong by taking the crown as NYC’s Best Neighborhood in 2016’s Curbed Cup, a first for any neighborhood outside of the five boroughs. Now, with the release of Pure Properties’ highly anticipated South Hudson County Market Report, the city has even more to brag about.

Historically a lower cost alternative to its northern neighbor, Downtown Jersey City, for the first time, overtook Hoboken as the more expensive nabe on the rental and condo side. Median rents for Downtown increased 2% year-over-year, settling at $2,700. Hoboken, on the other hand, saw a slight decrease with median rents coming in at $2,600. Condo sales increased roughly 8% in Downtown with a median price of $700,000. Hoboken, though, wasn’t far behind with a median price of $696,000, a 12% increase from the same quarter the year prior.

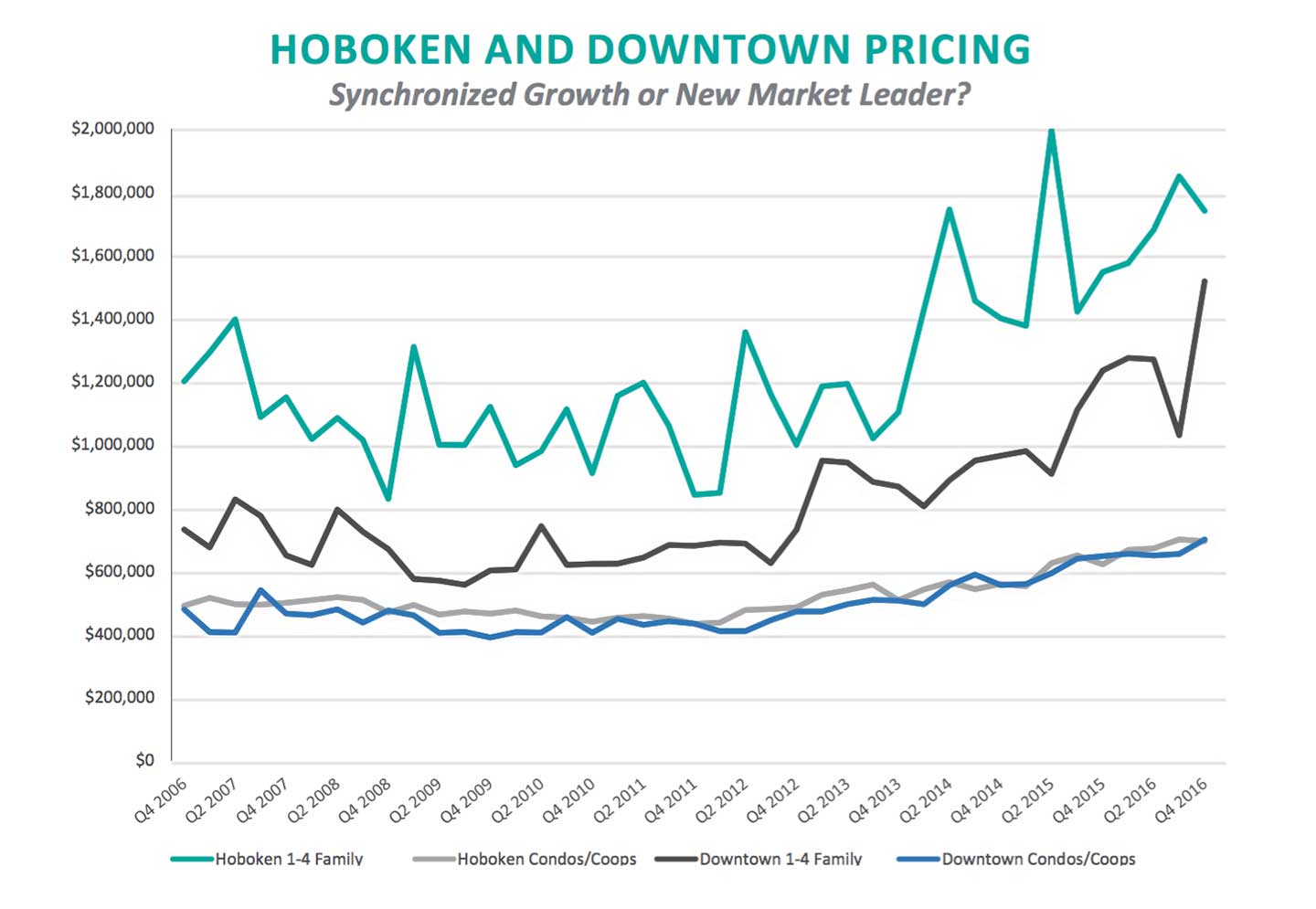

There were a few areas where Hoboken still holds the title, including median price for 1-4 family homes, and highest overall sales. The median price for a 1-4 family in Hoboken came in at $1,740,000, a 13% increase from the previous year. Comparably, Downtown Jersey City continues to lag behind in this category, although it’s catching up quickly, the median price for a 1-4 family in Downtown came in at $1,517,000, jumping 23% from $1,235,000 from a year prior. Considering the trends between these two areas, it appears there’s still a bit of upside on the 1-4 family market in Downtown.

Hoboken is still the champ for the highest single sales. The highest condominium sale for the quarter was a $2.55 million sale at Maxwell Place; and in the 1-4 family category, a Garden Street townhouse took the title, closing at $3,200,000.

Outside of these two neighborhoods, the Hudson County markets as a whole, with the exception of Bayonne, saw healthy annual growth. Increasingly popular Bergen-Lafayette showed the largest increase, 98% for 1-4 family homes. However, with few transactions, only five transactions last quarter and eight in the final quarter of 2015, this number is susceptible to large swings. With a healthy 61 transactions, Greenville jumped 38% year-over-year in the 1-4 family category, $248,000 compared to $180,000 the previous year.

Could last quarter be an indicator of a longer-term shift in the dynamic between Hoboken and Jersey City? Managing Director and Broker of Record for Pure Properties, Zeke Ortiz says, “We could speculate the reasons behind these short-term movements, however, we are cautious to draw long-term conclusions from a quarter that saw dramatic changes in the political landscape and a return to all-time highs in investment markets.“

Patrick Southern, Hudson County’s leading agent for eight years and Pure Properties representative, added, “The Presidential election was definitely a factor during the fourth quarter. Uncertainty had many buyers and sellers holding deals close to their chests as they waited for the outcome. Now that the election has passed, we’re starting to see a pulse again as markets regain momentum and people come back to the table ready to deal.”

In short, it’s still too early to tell, but based on the numbers, it will certainly be an interesting story to watch.

Click here for the full copy of the Q4 2016 Hudson County Market Report courtesy of Pure Properties.