When Pure Properties released their last quarterly market report in January, it was the first time that Downtown Jersey City median rental prices eclipsed those of Hoboken. Now, with the release of Pure’s Q1 2017 report, it appears the dynamic between the two areas continues to shift. This time, however, the shift comes on the sales side.

According to Pure’s Q1 2017 report, over the last quarter, the rental prices in the two areas have balanced back out, tying at $2,600. However, this most recent quarter saw Downtown median sale prices for 1-4 family homes outrank Hoboken for the first time since 1996 when MLS data launched.

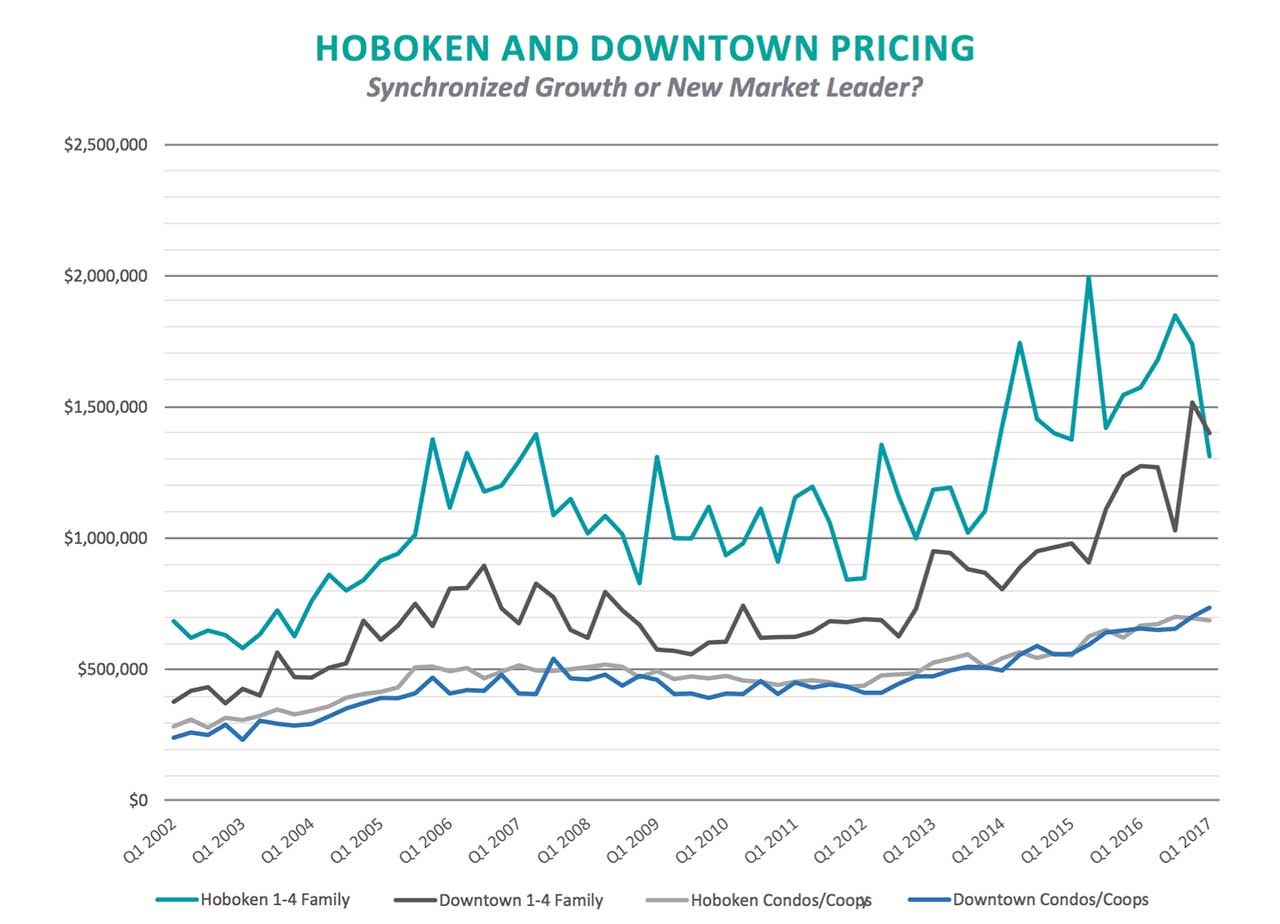

This adjustment is the result of large year-over-year price gains in Downtown paired with drastic declines in Hoboken. Since the same quarter last year, 1-4 family home prices in Downtown rose 10% to a median of $1,400,000. In Hoboken, 1-4 family homes saw price declines of -17% resulting in a median price of $1,312,500. In the first quarter, Downtown had 13 transactions in the 1-4 family category compared to 16 in Hoboken.

Similarly, on the condo side, Jersey City continues to outpace Hoboken. Around the middle of 2016, Downtown condo prices surpassed Hoboken and have since only continued to break away. This strengthening is also the result of strong gains in Downtown while Hoboken’s were more modest. Year-over-year Downtown condo prices rose 12% to a median price of $735,000. In Hoboken, prices rose just 3% to $685,000.

Interestingly, the number of condo transactions in both areas fell sharply from the previous quarter while each area’s average days on market increased. Many factors could be at play here, including uncertainty following the presidential election, increasing interest rates, softening in the NYC market, or simply seasonality. With the spring market upon us, it will be telling to see if this trend continues or corrects itself this quarter.

Jersey City’s other neighborhoods all had a strong year as well. Notably, in Bergen-Lafayette 1-4 family the median price increased 173% from the same quarter 2016. However, with only 8 transactions last quarter, it’s easy for these numbers to swing drastically. On the other hand, Greenville, with a healthy 57 transactions, saw median prices jump 31% year-over-year.

Across the board, 2016 turned out to be a very strong year for Jersey City real estate. Looking forward, however, the reality of Jersey City’s property revaluation is nearing. What effect this unpredictability will have on the market remains to be seen.

“Jersey City’s first property tax revaluation since 1988 is likely to elicit uncertainty among homeowners across the region, and may create compelling purchasing opportunities in neighborhoods most at risk of significant tax increases,” says Zeke Ortiz, Managing Director and Broker of Record at Pure Properties.

Given the difficulty in predicting the new tax rates, Jersey City Mayor Steven Fulop has encouraged homeowners to avoid making rash decisions and to let the revaluation process play out through to November. And while the full effect won’t be seen until after the new rates take effect, how the market performs over the next two-quarters will certainly be interesting to watch.

For more granular data on all the neighborhoods, download the full report, courtesy of Pure Properties, here: South Hudson County Market Report Q1 2017