The latest Pure Properties analysis on the Southern Hudson County market might sound like a re-run to those who watch real estate closely, as the county’s hottest neighborhood has continued to soar. But the newly-published 3rd quarter report also suggests that while appreciation is still generally good in most areas, value increases in two of the most prominent neighborhoods are slowing down.

The latest Pure Properties analysis on the Southern Hudson County market might sound like a re-run to those who watch real estate closely, as the county’s hottest neighborhood has continued to soar. But the newly-published 3rd quarter report also suggests that while appreciation is still generally good in most areas, value increases in two of the most prominent neighborhoods are slowing down.

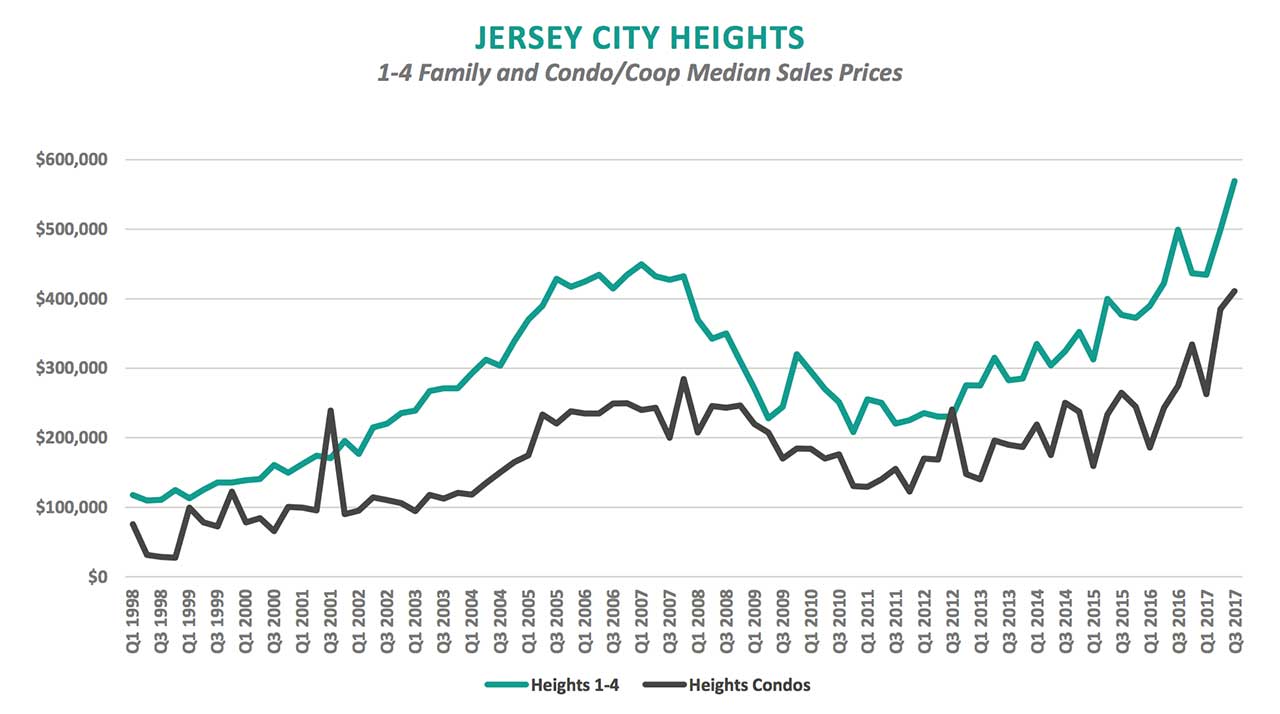

In what has become a familiar theme, The Heights is the biggest gainer during this year’s 3rd quarter, and home sale prices in the neighborhood have literally skyrocketed since this time last year. Last quarter’s report told a similar story, as sale prices in The Heights rebounded past their pre-recession numbers and median condo prices were up 64% year-on-year.

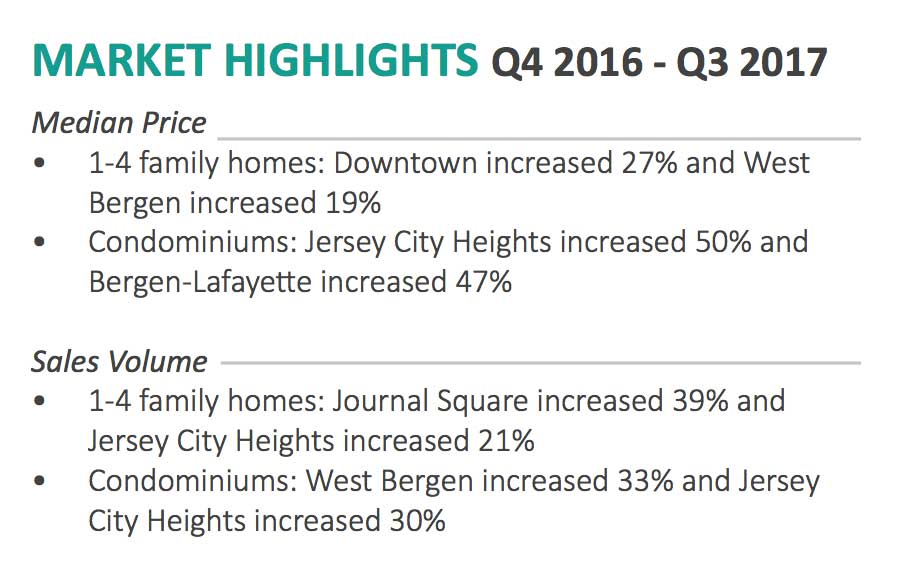

This quarter, the average sale price of 1-4 family homes in The Heights was up another 14%, clocking in at $570,000. Condominium sales averaged $412,000 and while that represented just a 7% quarterly change, condo prices are up a whopping 50% since the 3rd quarter of 2016. Median rent in the neighborhood clocked in at $1,850/month, a modest 3% yearly rise.

Conversely, Downtown Jersey City was a mixed bag in the quarter. The median sale price for homes was $1.31 million, representing a 5% quarterly increase and a 27% jump since last year. But the average sale price for condos dropped in the quarter to $715,000, a 2% decrease. Condo prices are still up from this time last year, but by just a modest 9%. The median rent, $2,600/month, was down 4% both for this quarter and for the year.

A similar tale is unfolding in Hoboken, where home sale prices were down slightly this quarter. The market leader saw homes in the city sell for an average of $1.66 million, off 1% in the quarter and down 10% from this time last year. Sales of condos in the Mile Square City fared a little better, averaging $752,745 and increasing 4% in the quarter and 8% year-on-year. Similar to Downtown JC, Hoboken’s $2,650/month average rent was down 2% in the last year.

While Hoboken and Downtown JC are still first and second in terms of highest values, an analysis of this quarter’s numbers suggests some softening in their appreciation potential. After Downtown values boomed and briefly overtook Hoboken as the market leader, a plateau appears to have been reached.

Some have speculated that Jersey City’s ongoing property revaluation, scheduled to wrap by the end of the year, has contributed to Downtown’s relative quiet due to fears over property tax increases. Total transactions Downtown are also down big from this time last year, hitting the condominium market particularly hard. 2016’s 3rd quarter saw 237 total Downtown condominium sales, while this year’s Q3 had only 161 transactions.

Elsewhere in the county, Journal Square continued its slow but steady growth. Sale price for homes rose to an average of $482,000, a 5% quarterly change and up 16% from last year. Condo sales were up to $300,000, a 9% quarterly jump and up 7% from last year. Rent actually went down year-on-year, falling 8% to an average of $1,750/month.

It was a mixed bag for Jersey City’s southern neighborhoods this quarter. Greenville’s home sale prices shot up 12% from last year to average $257,000, but condominiums in the neighborhood sold for an average of $380,000, a 15% yearly decrease. West Bergen fared a little better, with a 19% yearly increase in average home sale price to $320,000, while condo sale prices increased by 3% over the same period to $326,250. Bayonne’s average sale price for homes saw a modest 3% yearly increase to $350,000, while the value of condos sold fell 17% from last year to $165,000.

While there’s mostly good news in the report, it also raises a few questions, and may leave some wondering if sought-after neighborhoods along Hudson county’s waterfront are the still the investment they have been in years past.

While it’s too soon to tell whether the slow down in the most sought-after neighborhoods along Hudson county’s waterfront is temporary or part of a larger trend, it’s clear homebuyers and investors are seeing plenty of upside in the historically overlooked neighborhoods of Jersey City.

For more granular data on all the neighborhoods, download the full report, courtesy of Pure Properties, here: South Hudson County Market Report Q3 2017