Jersey City’s ongoing revaluation drama seems to have taxpayers either excited about relief or nervous about the consequences, emotions driven by uncertainty because New Jersey’s second largest city has not assessed its properties since 1989.

Jersey City’s ongoing revaluation drama seems to have taxpayers either excited about relief or nervous about the consequences, emotions driven by uncertainty because New Jersey’s second largest city has not assessed its properties since 1989.

Because of this long gap, the city has properties with average assessed values only about 27% of their actual value. The story of Jersey City’s latest reval was supposed to start in 2013, but newly elected Mayor Steve Fulop cancelled it, citing concerns about the way the contract for the work was awarded. He then publicly argued that the reval would hurt home values and force long-time residents in pricier areas to sell their properties due to tax increases.

Canceling the reval also led to a breach of contract lawsuit that the city recently lost, which some fear could cost taxpayers upwards of $8 million. Adding insult to injury, the state issued an order in April compelling Jersey City to revaluate their properties by 2017, which they’ve said they will comply with. Assuming they do, new tax assessments would go into effect for 2018.

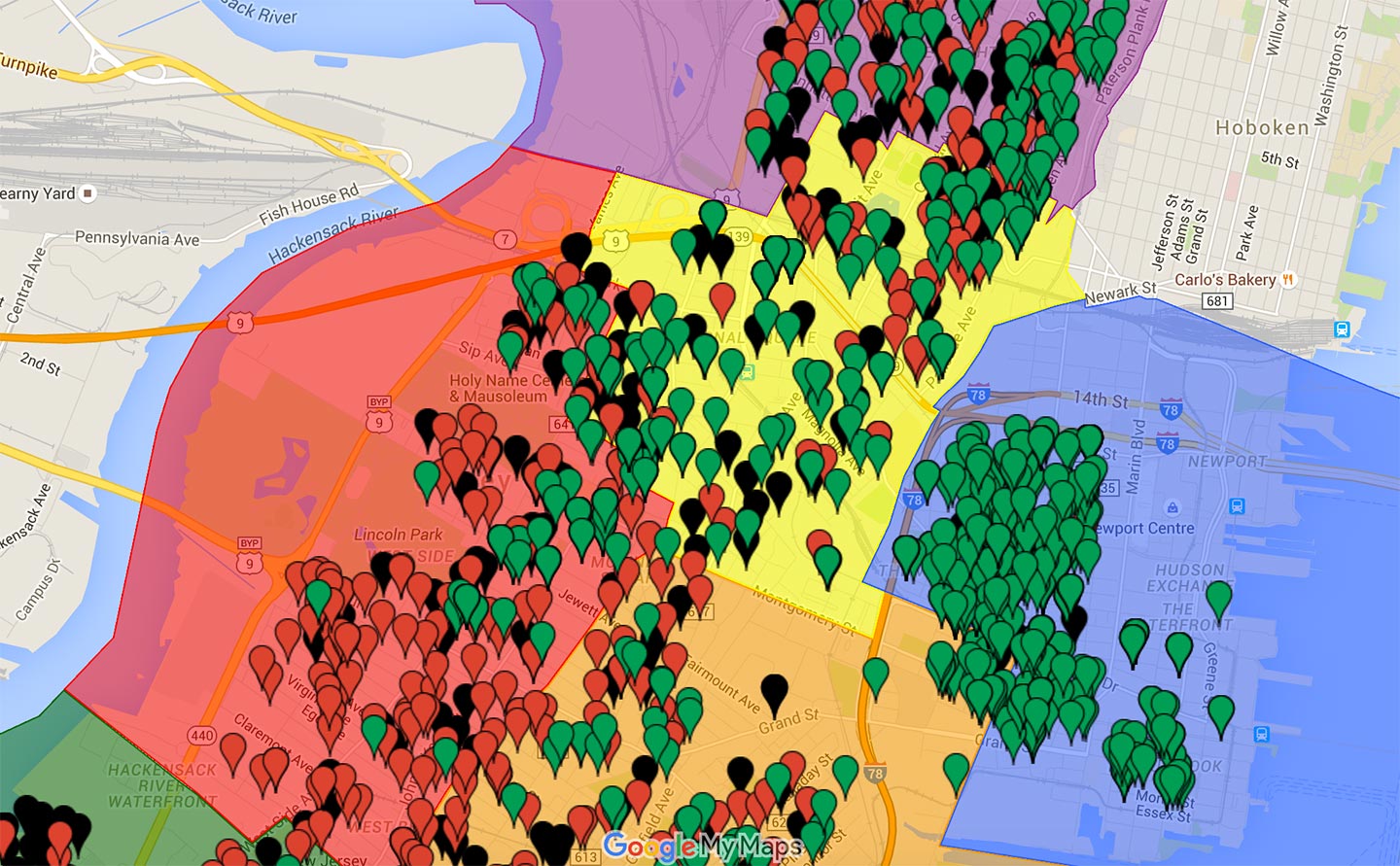

Civic JC recently created a map that shows areas in Jersey City where, based on assessed value versus sale price, recently sold properties may be underpaying on their tax bills.

*In the map above, created by CivicJC, Green properties are under-assessed, Black are fairly-assessed, and Red are over-assessed

Realty Appraisal Company argued in a lawsuit against Jersey City that Fulop cancelled the reval to benefit downtown homeowners and the map shows that they may have a point. Almost all of the recently sold properties downtown are under-assessed according to Civic JC, with many homes in The Heights also possibly underpaying on their tax bills.

However, it is worth noting that the map suggests a significant number of recently sold properties near the Journal Square PATH station are also under-assessed, demonstrating that the uneven values might be more spread throughout the city than some had thought. But how much taxpayers might be underpaying, who might be overpaying and how big a potential tax increase or decrease might be is somewhat hard to say.

However, Hoboken’s relative similarities to Jersey City could provide some insight into a post-reval world. That city performed a full revaluation in 2013 and Hoboken’s pricier areas did average higher tax bills post-reval, although not universally. As an example, an analysis of condominiums currently for sale in Maxwell Place shows that one unit saw its taxes go up as little as 1% post-reval, while a different condo for sale saw an increase of over 20%.

Additionally, more accurate assessments post-reval certainly hasn’t led to a flood of older homes hitting the market due to higher taxes, as most realtors agree that Hoboken, much like Jersey City, has an inventory shortage. Hoboken’s property values since the reval have also continued to steadily climb.

In the end, uncertainty regarding tax increases due to revaluations can hurt a real estate market, so getting the long-overdue reval out of the way may see positive results for the city. Some property owners will inevitably be unhappy about their new assessments (and the city should prepare for an increase in tax appeals), but performing a revaluation should create consistency and stability in the marketplace, in addition to leveling the playing field.

Jersey City can also take solace knowing that they are in good company. The Tax Court of New Jersey ordered Weehawken to perform a revaluation last July and Bayonne was also ordered to undergo a reval in April. East Newark and Harrison also received notices to revaluate from the state in May, so while it’s been decades since most of Hudson county has re-assessed their properties, revals are going to get a lot of press over the next few years.