Another tax break for a real estate developer in Jersey City in exchange for more affordable housing and union labor?

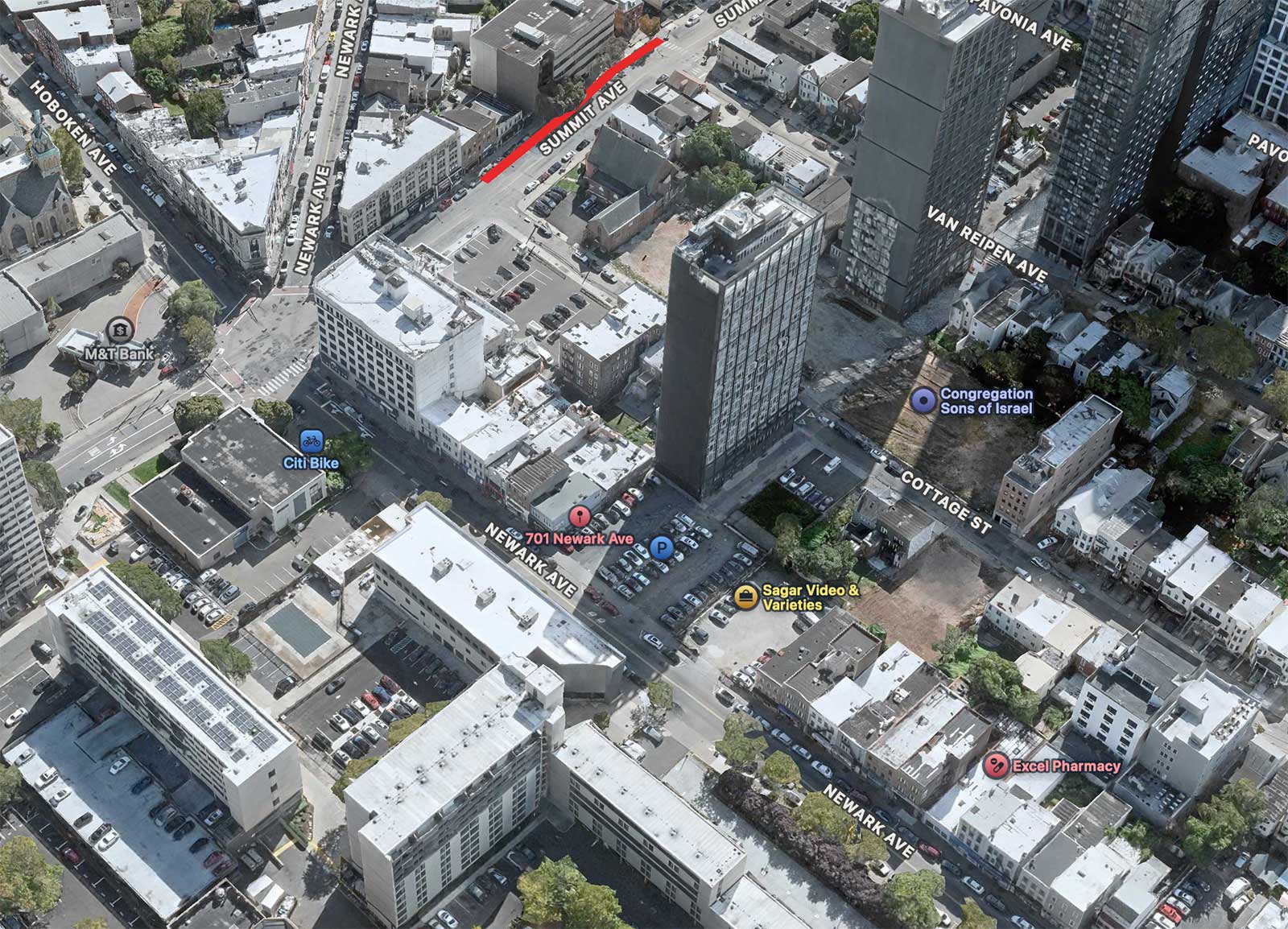

The Jersey City Municipal Council recently advanced a long-term tax exemption for a new mixed-use development project contemplated in Journal Square on a site currently occupied by a parking lot.

At its April 9 meeting, the City Council voted 7-1-1 to introduce an ordinance that would approve a 30-year tax exemption for 701 Newark Avenue LLC, the property owner of 693-701 Newark Avenue.

According to the ordinance, the property owner has indicated that a 30-year long-term tax exemption is necessary to receive funding from the New Jersey Housing and Mortgage Finance Agency (NJHMFA).

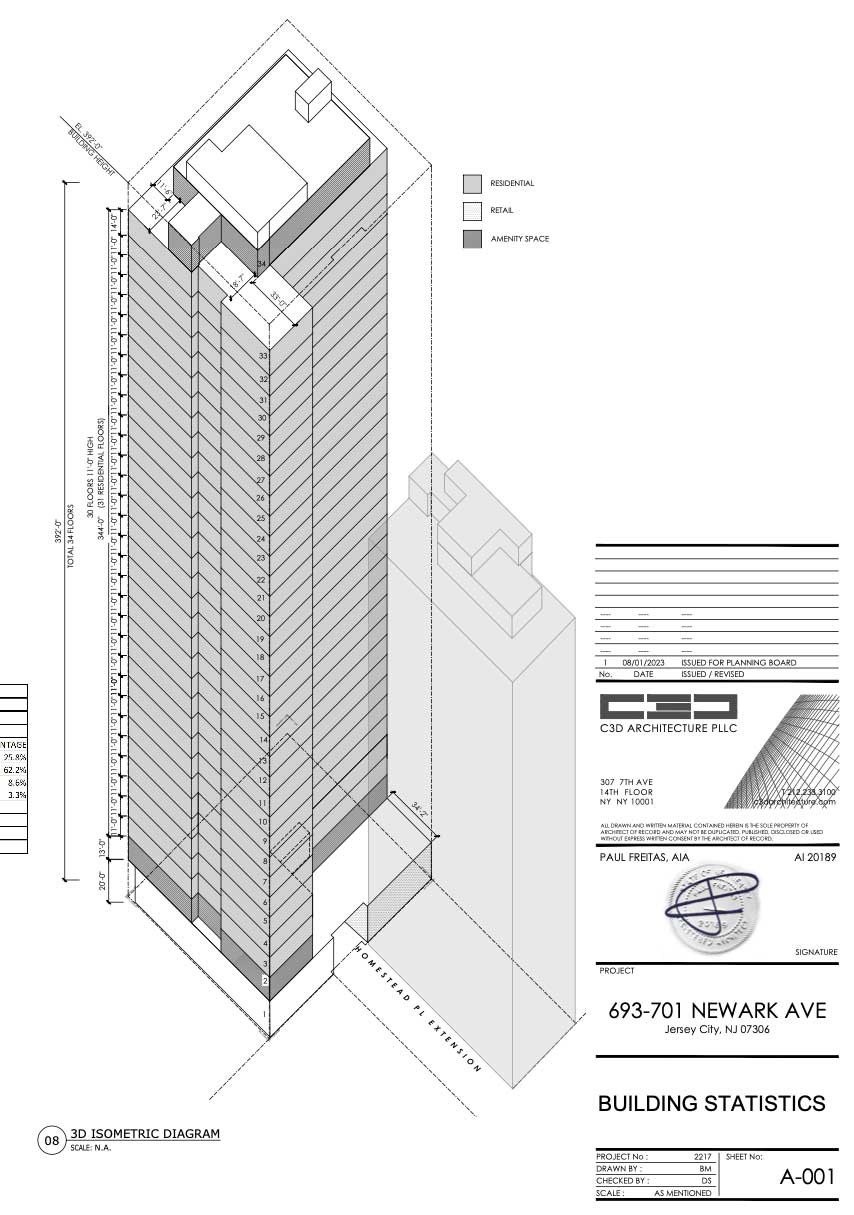

The NJHMFA financing would amount to $11,537,940, which would be used to construct a new 35-story mixed-use commercial and residential redevelopment at 693-701 Newark Avenue.

The new building will house 360 housing units, 90 of which will be affordable, as well as 2,979 square feet of commercial space and amenities.

Under the agreement, 701 Newark Avenue LLC would pay the City, in lieu of property taxes, 11 percent of annual gross revenue for the first fifteen years. Dubbed the annual service charge, that fee is estimated to be $6,513,936 for the first five years after the project is completed.

According to the ordinance, the annual service charge would increase to 12 percent of the annual gross revenue for years 16 through 20. An additional increase would occur to 13 percent of the annual gross revenue for years 21 to 30.

Under the tax exemption, the property owner would also pay an annual administrative fee equal to two percent of each prior year’s annual service charge. That fee is estimated to be $137,135 in the first five years until an auditor’s report determines the correct amount due.

According to the ordinance, the long-term tax exemption would create approximately 650 temporary new construction jobs considered equivalent to full-time jobs and 20 permanent full-time jobs.

The ordinance continues to state that the project would also otherwise “provide employment and other economic opportunities for City residents and businesses,” as cited.

The ordinance further stipulates that this tax exemption will stabilize and contribute to the economic growth of businesses in the surrounding area. Additionally, it points to the city’s impact analysis, which indicates that the benefits of the long-term tax exemption outweigh the costs to the city.

The long-term tax exemption is significant in developing the project, according to the ordinance, because the relative stability and predictability of the annual service charge will make the project more attractive to investors. These investors are needed to finance the project and satisfy necessary requirements to receive the aforementioned NJHMFA financing indicated by the agreement.

That same stability and predictability of the Annual Service Charge would also allow the owner to stabilize its operating budget and thus see a high level of maintenance of the building over the life of the project.

The ordinance argues this will attract tenants to the project and ensure the likelihood of success.

The tax exemption would exist for 35 years from the adoption or 30 years from the date of the project’s completion, whichever is earlier. The ordinance would sunset, and the tax exemption would terminate unless construction commences in two years and is completed within five years.

According to the ordinance, the applicant will pay full real estate taxes until the annual service charge becomes effective. The required financing must be secured before construction can commence.

At the April 7 Caucus Meeting, applicant attorney Charles Harrington III told the City Council that this agreement would ensure the use of union construction labor and more affordable housing units that will be specifically reserved for very low-income residents. He said that these units are unique in that they will be reserved for those who make at a maximum of 50 percent or less of the average median income.

“I don’t think any other project in the City has that,” Harrington said. “We’d have 25 percent affordable units in the project at income levels of a maximum of 50 percent AMI, which serves a specific demographic that… I don’t think you don’t see that. I don’t think Bayfront has that even.”

When the City Council voted 7-1-1 to advance the ordinance to approve the long-term tax abatement, Ward C Councilman Richard Boggiano was the sole abstention, and Ward F Councilman Frank Gilmore was the only no vote.

At the April 9 regular Council meeting, Boggiano told his council colleagues that while he supports the creation of union jobs and the additional affordable housing this arrangement would bring, the long-term tax exemption is an “imbalance of what the City is getting for what it has already given.”

He took issue with the fact that the City initially owned the property before selling it to the Jersey City Redevelopment Agency, who then sold it to the current property owner and isn’t getting a better deal.

“This was originally City property that we sold. And frankly, we should be getting more for it without giving out massive tax breaks,” Boggiano said. While Business Administrator John Metro said he wasn’t sure of the price of the parcels, he would get that information to the City Council.

According to Boggiano, the City Council has already agreed with 701 Newark Avenue LLC to enter the Aspire program to acquire state funding so the project could have 20 percent affordable housing. The exemption would only add another 5 percent of affordable housing and the stipulation of the use of union labor via 32BJ in the construction of the building, Boggiano argued.

“Now they are moving the goalposts yet again by telling us that it can’t get completed with a PILOT and tax incentives, and it’s got to stop,” he said.

Boggiano said that the City needs to demand more of real estate developers instead of “just giving everything away to them.” He said that homeowners don’t get breaks on their taxes like this, and that it isn’t necessary when neighborhoods are booming with construction across Jersey City.

“We need to stop worrying about helping developers and start focusing on the residents who make this City home,” added the councilman. “And if this developer can’t build this project with adorable housing and union labor and the breaks we already gave them, well there’s a lot more developers out there who can without a tax abatement.

Just look at all the buildings that are going up in Journal Square… We already passed an affordable housing ordinance in Jersey City for the Journal Square area where 10 percent of housing being built has to be affordable. So here, I think we should start worrying about the… tenants that live in buildings now and take care of them.”

Gilmore had Metro clarify that, without this tax exemption, the percentage of the affordable housing units required in the building would fall to 20 percent because of the Aspire program.

Metro also clarified in response to Ward D Councilman Yousef Saleh that this tax break would essentially secure the additional 5 percent of affordable housing and the inclusion of union construction labor.

Prior to this application by 701 Newark Avenue LLC, the site was previously eyed for a Dream Hotel before plans fell through. It still remains a municipal parking lot and will continue to until construction commences.

“As I stated during the meeting the other night, I am 100% behind union labor and affordable housing. In fact I would have required both when the JCRA first made the deal to sell the land,” added Boggiano.

“It’s just one more example of the imbalance in the City where developers are getting lucrative deals while the rest of us have to pay the bill. And it’s got to stop.”