A nine-building multifamily portfolio in northern New Jersey was recently sold for $6,826,500.

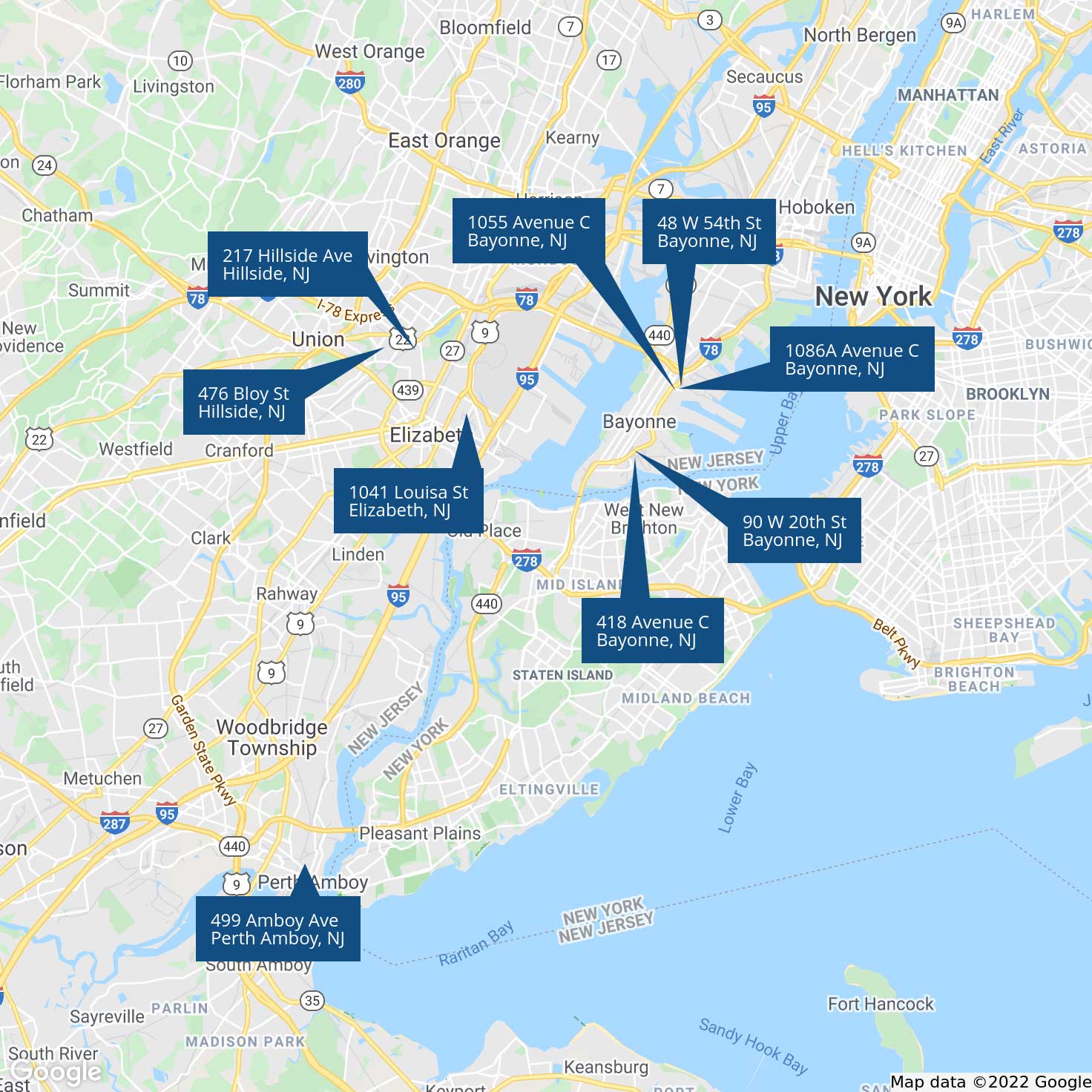

The properties, some of which featured a mixed-use component, are located throughout Hudson, Union, and Middlesex Counties. The transactions occurred between August 2021 and January 2022.

The properties were marketed on an exclusive basis by The Kislak Company, Inc (Kislak). Kislak vice president Tom Scatuorchio handled the assignment and co-listed the portfolio’s Bayonne properties with vice president Davis Briones. They represented the purchasers of the Bayonne properties, while Mr. Scatuorchio also represented the purchasers of the other properties.

The Bayonne properties accounted for more than half of the portfolio. 1086, 1088, and 1090 Avenue C – encompassing six residential units and three commercial spaces – sold for $1,175,000, while 1055 Avenue C, which included six residential units and two commercial spaces, sold for $950,000,000. 90 West 20th Street with five residential units sold for $757,500 and 48 West 54th Street with four residential units for $600,000. 418 Avenue C with three residential units and one commercial space also sold for $600,000.

The Hillside properties included 217-219 Hillside Street with eight residential units sold for $800,000, while 476 Bloy Street with one residential unit and one commercial space was sold for $400,000.

Additionally, 1041 Louisa Street in Elizabeth with four residential units and four commercial spaces was exchanged for $1,045,000, and 499 Amboy Avenue in Perth Amboy with three residential units and one commercial space for $499,000.

Mr. Scatuorchio commented on the sale of the portfolio, “It has been exciting to represent our valued clients on this project. The sellers purchased the properties as part of a larger bank-owned portfolio just over a year ago. The portfolio included numerous distressed properties across many New Jersey markets. Given the nature of the initial portfolio acquisition, each deal presented its own unique complexities for marketing and sale. However, we quickly identified the right buyers for each property and generated multiple strong offers on all of them, and some of our marketing efforts resulted in bidding wars. These transactions exemplify the continued and increasing demand for investment real estate throughout New Jersey.”

Regarding the Bayonne sales, Mr. Briones added, “This was a complex portfolio sale with multiple buyers, and I congratulate everyone involved. The Bayonne real estate market continues to strengthen as investors search for value-add properties and development projects. The Bayonne market is among New Jersey’s most dynamic, with Class A, B and C occupancy rates near 100 percent and rents more than doubling over the past six years.”