A portfolio of affordable, income-restricted multifamily properties in northern and central New Jersey was recently sold for $14,145,000.

The portfolio encompassed four properties and totaled 121 units: Eagle View Apartments, The Hills at Rockaway, The Preserve at Matawan, and Don’s Apartments. The properties offered a mixture of unit types.

Eagle View Apartments included 48 units, with 10 one-bedroom units, 28 two-bedroom units, and 10 three-bedroom units. Built in 2017 and situated at 206 Joan Warren Way/402 Market Street in Monroe Township, Middlesex County, the property sold for $7,275,000.

The Hills at Rockaway contained 30 condominium units operated as rentals within a 142-unit condominium townhouse complex at Parkview Lane in Rockaway, Morris County. Built in 2017, the income-restricted units sold for $3,200,000.

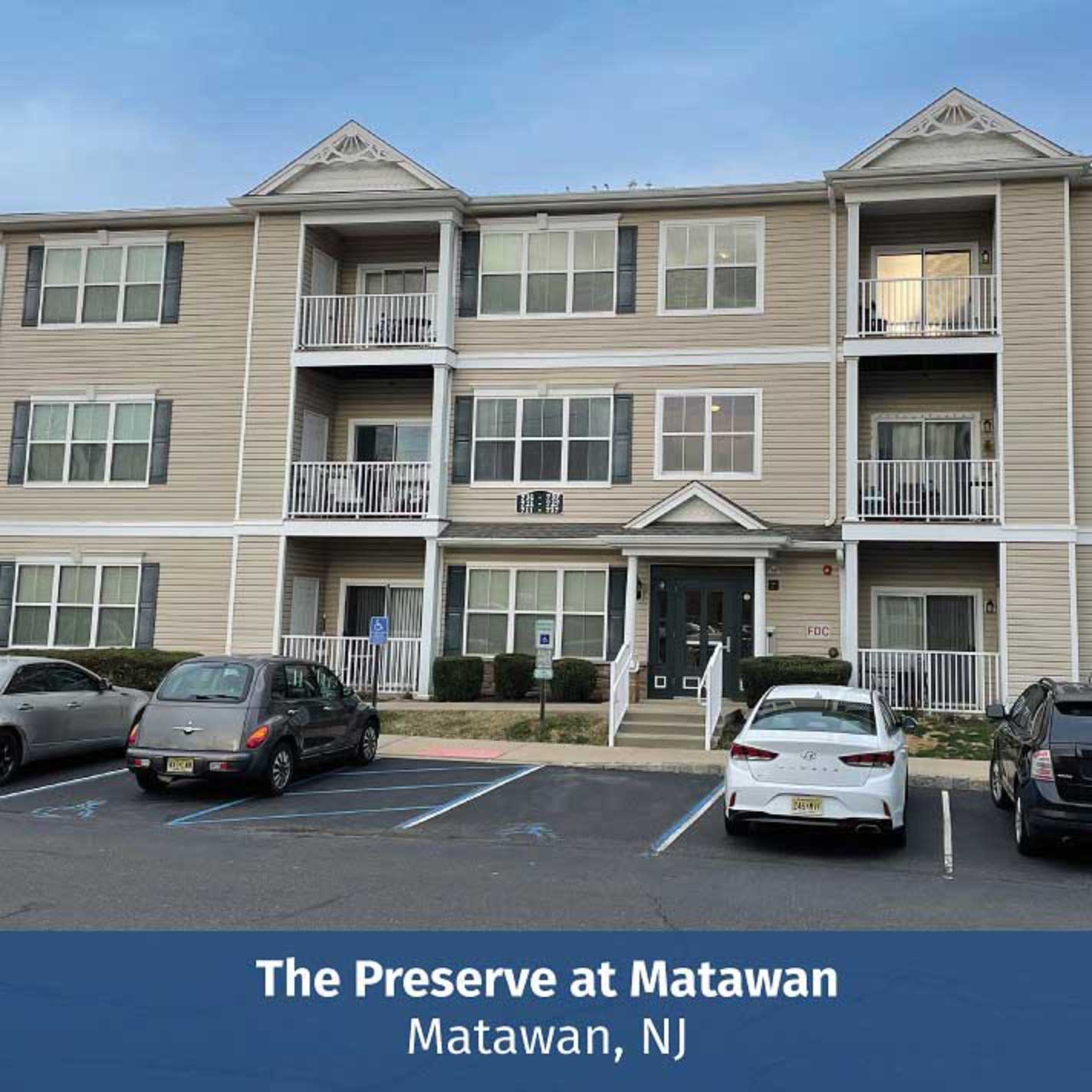

The Preserve at Matawan features 31 condominium units operated as rentals within a 157-unit condominium complex. The property consisted of six one-bedroom units, 16 two-bedroom units, and nine three-bedroom units. Built in 2009 and located at Sloan Court in Matawan, Monmouth County, this property sold for $2,370,000.

Don’s Apartments consisted of 12 income-restricted units located at 660 South Orange Avenue in Livingston, Essex County. Built in 2019, the property includes two one-bedroom units, seven two-bedroom units, and three three-bedroom units. The property sold for $1,300,000.

The properties were marketed by The Kislak Company, Inc. on an exclusive basis. Kislak’s executive vice president Matt Weilheimer handed the assignment and procured three purchasers for the four properties. The parties involved in the transaction were not disclosed.

Mr. Weilheimer commented, “The availability of the portfolio presented a rare opportunity for investors to acquire 121 desirable affordable housing units in very strong northern and central Jersey locations. The properties had between 17 and 27 years of affordability restrictions left on the initial terms. For many years, we saw a limited number of investors owning and operating in the affordable sector but now, especially given the need for affordable housing, the demand is increasing among investors including some who traditionally focused on market-rate housing. We experienced this trend firsthand with our marketing and sale of the portfolio.”