For the last two decades, the population of West New York, New Jersey has been growing, making the 1.007 square mile town along the Hudson River one of the densest places in the country. Now, as the population and cost of living in nearby municipalities like Jersey City and Hoboken continue to skyrocket, northern Hudson County municipalities like West New York are seeing more growth.

The West New York master plan states that “the 2013 Reexamination Report noted that the population growth in West New York over the last 20 years is indicative of the fact that West New York is a desirable place to live,” and that this has led to “growth and development pressures,” particularly causing developers to be “seeking to develop more in the upland or older portion of the town.” In fact, that area, which sits atop the Palisades, will soon be the site of five new residential developments, all of which will contain well over a dozen units and could receive five-year tax exemptions from the municipality.

Construction is currently underway at the site of the largest project proposal. A new building with 52 residential rental units is rising at 309-321 54th Street, between Palisade Avenue and Hudson Avenue, near Public School No. 5, according to a legal notice. The developer, TAH Hudson Heights 54th Street, LLC, is based out of the same Manhattan offices at Tenth Avenue Holdings, which is responsible for other area projects like 6K8 on Hudson Avenue at The Residences at 68 West in Guttenberg. Upon completion of the tax exemption for the newest development, the property is expected to generate $156,906 in improvement taxes.

This lot, along with several neighboring lots, was among the last undeveloped tracts in the town, and contained vacant grassy parcels and unused buildings before construction began. One of the other lots, neighboring 314-322 53rd Street, will be the site of a building developed by TAH Hudson Heights 53rd Street, LLC that will contain 28 residential rental units upon completion.

In 2015, the West New York Zoning Board of Adjustment approved a proposal by Tenth Avenue Holdings for the company to not be “required to provide affordable units or obtain financing through the HMFA [Housing and Mortgage Finance Agency] program as a condition of approvals.” The developments are being promoted on the company’s website at ‘320 WestNYNJ’ and ‘321 WestNYNJ’.

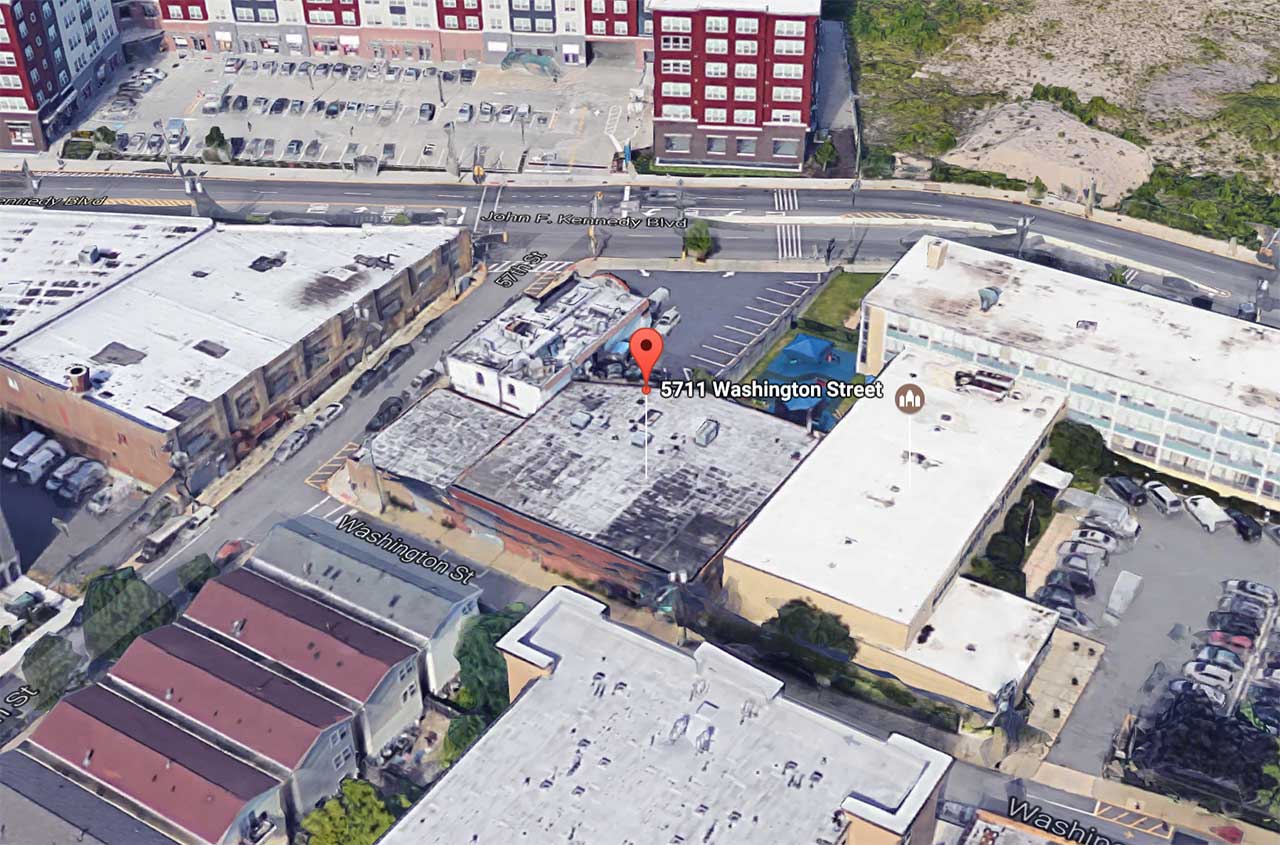

Another one of the new buildings is coming to 5701-5711 Washington Street, between 57th Street and 59th Street. Developer 5711 Washington St., LLC, which is based out of the Englewood Cliffs, Bergen County offices of Premier Developers, is planning for the building to include 24 residential rental units, with one parking space provided for each unit, according to a legal notice and public records. The property previously contained a one-story warehouse used by companies like Screenco. Once the tax exemption is expired, the taxes on property improvements are slated to be $84,977 per year.

Just up the street at 5800 Washington Street, the site of a one-story warehouse previously used by companies like Nunez Distributors, will also be the site of a development. 5800 Washington Street, LLC, which is registered out of the same Englewood Cliffs address at the other project down the block, acquired the property in 2015, and is planning to have the upcoming building contain 18 units, a legal notice states.

Lastly, several blocks away, 5208-5214 Polk Street, LLC, which is registered out of the same Englewood Cliffs address as the previous two developers, is planning a building with 20 residential rental units for 5208-5214 Polk Street, between 52nd Street and 54th Street. The site previously contained two buildings used for industrial purposes by companies like Kavita Textiles.

All of the developers applied for a five-year tax exemption, and are slated to pay an annual payment in lieu of taxes (PILOT) on improvements to the property, in addition to the taxes on the land itself. The tax exemption ordinances were adopted for first reading by West New York’s Mayor and Board of Commissioners on March 23rd. During its meeting on April 20th at the Municipal Building, the Board held a public hearing before voting on final passage of all five ordinances.