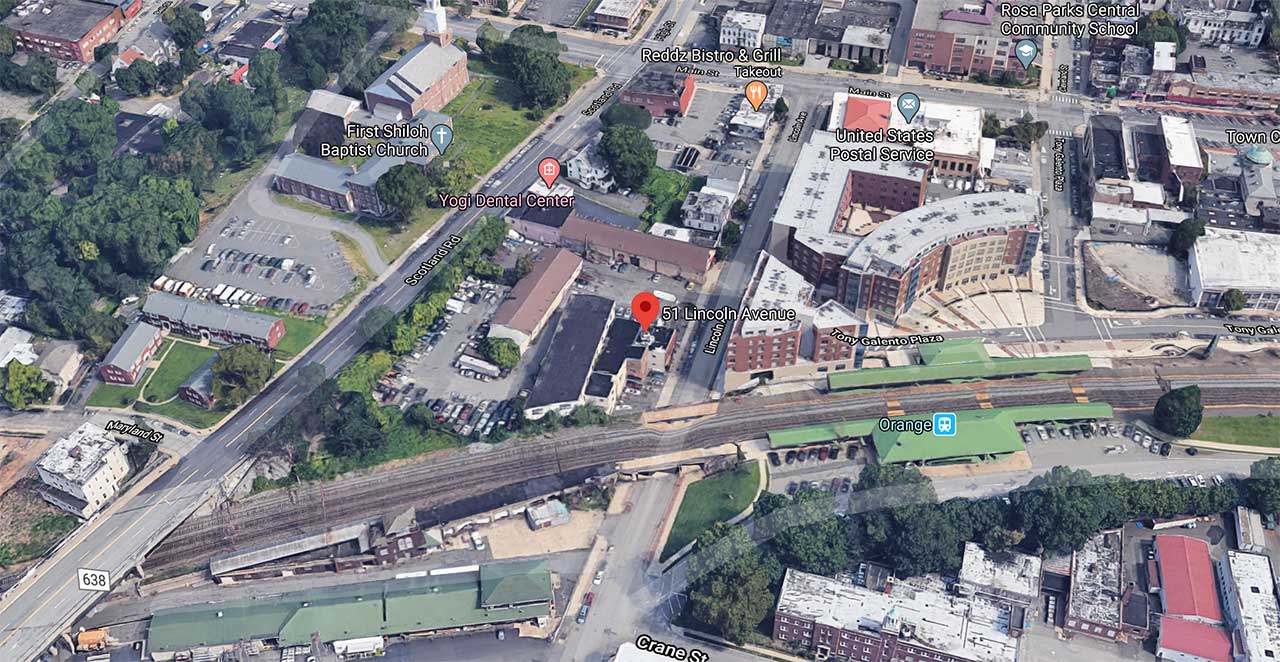

The developer of a new multi-family complex that is in the works for a group of properties near Orange’s main train station could receive a lengthy tax exemption from the municipal government.

A newly proposed ordinance calls for giving D&R Orange Urban Renewal II, LLC, a firm associated with Carlstadt-based Russo Development, a 30-year tax exemption for the residential project at 33, 43, 51, and 53 Lincoln Avenue along with 60 Scotland Road.

Annual service charges in lieu of taxes would range from 2.25 percent during the first year of the exemption to seven percent during the 30th year, according to a draft financial agreement.

The proposed resolution states that the building will include roughly 201 “market rate rental apartment units,” fitness rooms, and a two-level parking garage.

Each level of the garage will include around 147 spaces, with the lower level being leased to the City of Orange Township for at least 30 years for public use, according to the proposed resolution. However, this document notes that “a portion of such lower level spaces [are] to be made available with priority to tenants of the apartment project for lease on a subscription basis from the City.”

The proposed ordinance also claims that “the Mayor and City Council finds [sic] that the relative benefits of the project to the City outweigh the costs to the City associated with granting the long term tax exemption in that it will provide needed housing, retail and public parking, create both temporary and permanent jobs within the City, enhance the quality of life for residents in and around the project and that it will be important in influencing the locational decisions of probable occupants of the project.”

Jersey Digs first reported on this proposed development in July after Russo Acquisitions, LLC applied for preliminary and final site plan approval. The company’s application was subsequently approved by the Orange Planning Board.

The Orange Municipal Council is scheduled to introduce this ordinance, along with a separate $250,000 bond ordinance related to infrastructure associated with this project, and conduct a first reading motion during its Zoom meeting this Tuesday, December 1 at 7:00 p.m.

The meeting agenda states that the bond ordinance is then scheduled to be up for final approval on December 15 while the tax exemption ordinance’s final reading is expected to take place on January 5, 2021.

Note to readers: The dates that matters are scheduled to be discussed by the Orange Municipal Council and other governing bodies are subject to change.

Related:

- Council Could Revoke Plans to Sell Former Orange Police Station to Condo Developer

- Preservation Commission Takes Final Stand to Save Historic Hospital in Orange

- Wawa Location Could Open Along Orange’s Main Street